Hello, 👋

We all take birth in different kinds of economic systems. We spend our lives playing by the rules of these systems. Our dreams, our aspirations, our role models, etc. often have strong connections with this system. We all dream of becoming rich and living the lifestyle of our desire. We earn, we spend, we budget, we invest to fulfill our and our family’s needs and aspirations. We can’t run from it because the economic system is an essential part of the human ecosystem.

What we can do is to manage it efficiently to achieve our goals. And here comes personal finance. We all have heard about it from different social media influencers, books, etc. but most people still struggle to have a comprehensive understanding of the fundamentals. In this post, we will try to create a mental model for personal finance so that you can remember it and use it easily in your life. Enjoy!

Garvit Sahdev enjoys understanding ideas that shape our world. The Thoughtful Tangle is an initiative to share this journey and experience with his friends who love to do the same. He selects one idea and dives deep into it to understand its basics, relevance, impact and opportunities around it. The thoughtful tangle is special because 👇

📝 One long article per idea. We call it ‘The Basics’.

📝 Multiple unique insights. Separate small articles for special ‘Insights’.

🧑🤝🧑 Experts perspective. Check out ‘Insiders’

We are doing a series on ‘money’ as it is truly an idea which shaped the evolution of humanity and is still shaping it in many ways. Check out this series at

» The Money Series | The Thoughtful Tangle

Personal Finance Mental Model

Personal finance mental model consists of 7 elements i.e. foundation, income, spending, saving, investing, debt management and financial planning. We will cover each of them at a macro level so that you can develop a comprehensive understanding. We will try to go deep into each of these segments in coming parts of this series. Now, let us start with Foundation.

Financial literacy is important for better understanding of the model and how to use it. In this section, we will try to understand the langauge of finance.

Understanding Financial Terms

Supply and Demand: These are key forces that drive the prices of goods and services. When supply is high and demand is low, prices usually fall, and vice versa.

Inflation: Inflation is the gradual increase in prices over time. It reduces the purchasing power of money. For example, what cost $100 today may cost $110 next year due to inflation. You can read our older posts to dive deep into this.

Interest Rates: This is the cost of borrowing money or the return on money saved. A high interest rate makes loans more expensive, but savings more rewarding.

Opportunity Cost: This is what you give up when you choose one financial decision over another. For instance, buying a car might mean you have to delay investing in stocks.

Assets: Things you own that have value, like your house, car, or investments.

Liabilities: Debts or obligations, such as loans, credit card balances, or mortgages.

Credit: The ability to borrow money or access goods/services with the promise to pay later.

Investments: Putting money into assets like stocks, bonds, or real estate with the hope of earning returns over time.

Bank Statements: These track all your transactions over a period—how much money is coming in (income) and how much is going out (expenses).

Income Statements: Used by businesses to track revenues, expenses, and profits over time. As an individual, this can be applied to your own income and spending.

Balance Sheet: A snapshot of what you own (assets) and owe (liabilities) at a specific time, helping you calculate your net worth.

Money Mindset

This section dives into your personal attitudes and beliefs about money, which influence your financial habits.

Relationship with Money

Emotional Connection: Some people see money as security, while others see it as freedom or even stress. How you feel about money will shape your spending, saving, and investing habits.

Spending Triggers: Understanding what makes you spend impulsively (e.g., stress, social pressure) can help you gain control over unnecessary spending.

Financial Goals and Values

Short-term Goals: These are immediate needs, like building an emergency fund or saving for a vacation.

Long-term Goals: Larger financial aims, such as buying a house, funding your child’s education, or saving for retirement.

Aligning with Values: Your financial goals should reflect what matters most to you. If freedom and security are important, you may prioritize saving and investing over luxury spending.

Behavioral Finance

Cognitive Biases: Humans often make irrational financial decisions. For example, loss aversion means we fear losses more than we value equivalent gains, leading to overly cautious investment choices.

Herd Mentality: This is when people follow others without thinking, such as investing in a popular stock without doing research.

Self-control: Some people struggle to save because they give in to immediate gratification (spending on what feels good now) instead of planning for future needs.

Financial Health Metrics

This section provides concrete indicators to measure and improve your financial well-being.

Net Worth

Formula: Net worth = Total assets - Total liabilities.

Assets: This includes things like your savings, investments, real estate, and any other valuable possessions.

Liabilities: This includes debts like your mortgage, student loans, credit card balances, or personal loans.

Tracking Net Worth: Monitoring your net worth regularly can help you see your overall financial progress. If it’s growing, you’re building wealth; if it’s shrinking, you may need to adjust your spending or debt strategy.

Debt-to-Income Ratio (DTI)

Formula: DTI = Total monthly debt payments ÷ Gross monthly income.

Why it matters: Lenders use this ratio to determine if you’re a good candidate for loans. A lower DTI means you have more room in your income to take on new debt if needed.

Ideal Range: Typically, a DTI under 36% is considered healthy, meaning your debt is manageable in relation to your income.

Savings Rate

Formula: Savings Rate = Savings ÷ Income.

Importance: This metric shows how much of your income you are putting aside for future needs or investments. A higher savings rate indicates that you are well-prepared for emergencies or retirement.

Goal: Aim to save at least 20% of your income. This can be a mix of emergency savings, retirement contributions, and long-term investments.

Income Management Model

Let's go into more detail for each part of this income model.

Active Earning

This section is about how you can actively increase your income through different strategies.

Salary Optimization

Salary optimization refers to strategies you can use to maximize your earnings from your main job. It includes:

Negotiating your salary: When starting a new job or during performance reviews, understanding your market value and advocating for a better salary or benefits package.

Bonuses and perks: Besides base pay, there may be opportunities to ask for bonuses, stock options, or other perks like remote work or more paid time off.

Continuous learning: Staying up-to-date with skills and certifications can put you in a stronger position to ask for raises or promotions.

Side Hustles

Side hustles are extra jobs or projects outside your main job that bring in additional income. Examples include:

Freelancing: Using skills like writing, graphic design, or programming to take on short-term gigs or projects.

Tutoring or teaching: If you have expertise in an area, you can offer lessons, classes, or mentorship.

Gig economy work: Platforms like Uber, Lyft, DoorDash, or Airbnb allow you to earn money through driving, delivering, or renting out property. The idea is to leverage your free time or existing resources to create extra streams of income.

Passive Income Streams

Passive income means earning money with minimal effort after the initial setup. Some examples include:

Investments: Buying stocks, bonds, or mutual funds that grow over time and pay dividends or interest.

Real estate: Purchasing property and renting it out for monthly income.

Content creation: Writing a book, creating a course, or running a YouTube channel that generates revenue through sales or ad revenue long-term.

Royalties: Earning money from intellectual property like patents or creative works. The goal is to build systems or assets that make money without requiring constant effort.

Career Development

This area focuses on long-term strategies to increase your income by advancing your career.

Skills Enhancement

In a competitive job market, improving your skills can increase your value as an employee and your earning potential. This can involve:

Upskilling: Learning new skills relevant to your field, like a new programming language for tech jobs or marketing strategies for business roles.

Certifications and degrees: Earning specialized certifications or pursuing advanced degrees to qualify for higher-paying positions.

Continuing education: Taking part in workshops, online courses, or seminars to stay current on industry trends.

Networking

Building strong professional relationships can lead to better job opportunities and partnerships. Networking involves:

Attending industry events: Going to conferences, meetups, or webinars to meet people in your field.

Joining professional organizations: Becoming a member of trade groups or online communities like LinkedIn can connect you with key people who might help you land a better job or get a promotion.

Leveraging contacts: Keeping in touch with former colleagues, bosses, or mentors who can provide career advice, job leads, or endorsements. Good networking can open doors that skills alone might not.

Entrepreneurship

Starting your own business or becoming an entrepreneur can lead to financial independence. Key elements include:

Identifying a niche or opportunity: Finding a gap in the market where you can offer a product or service people need.

Building a business plan: Outlining the steps, financing, and resources needed to start your business.

Managing risks: Understanding the risks of entrepreneurship and making sure you have a safety net, like savings or a fallback plan. Being your own boss means you control your income potential, though it requires more upfront risk and effort.

Income Protection

This section is about protecting your income and financial security against unexpected events or downturns.

Emergency Fund

An emergency fund is a savings buffer that you can use for unplanned expenses, like:

Job loss: Covering living expenses if you lose your job.

Medical emergencies: Paying for urgent medical treatment or hospital bills.

Major home or car repairs: Handling costly repairs without taking on debt. Experts recommend having 3-6 months' worth of living expenses saved in an easily accessible account. This fund helps you avoid financial stress during hard times.

Insurance (Health, Disability, Life)

Insurance helps you protect against financial loss from unexpected life events:

Health insurance: Covers medical costs like doctor visits, surgeries, and prescription drugs. It protects you from being financially wiped out by medical bills.

Disability insurance: Replaces part of your income if you’re unable to work due to illness or injury. This is critical if you rely heavily on your paycheck to live.

Life insurance: Provides financial support to your family if you pass away. It can help pay for funeral costs, debts, and ongoing living expenses for your dependents. The right insurance coverage ensures that you and your loved ones are financially protected when life throws challenge your way.

Legal Protections

Having proper legal safeguards can protect your income and assets. Some areas to consider:

Contracts: Ensuring your employment or freelance work is secured by a clear, written agreement that outlines your rights and obligations.

Estate planning: Preparing documents like wills, trusts, or powers of attorney to manage your assets and decisions in case of incapacity or death.

Liability protection: If you're a business owner, incorporating or forming an LLC can shield your personal assets from business debts or legal claims. These legal steps can give you peace of mind and protect your financial future.

Spending Management Model

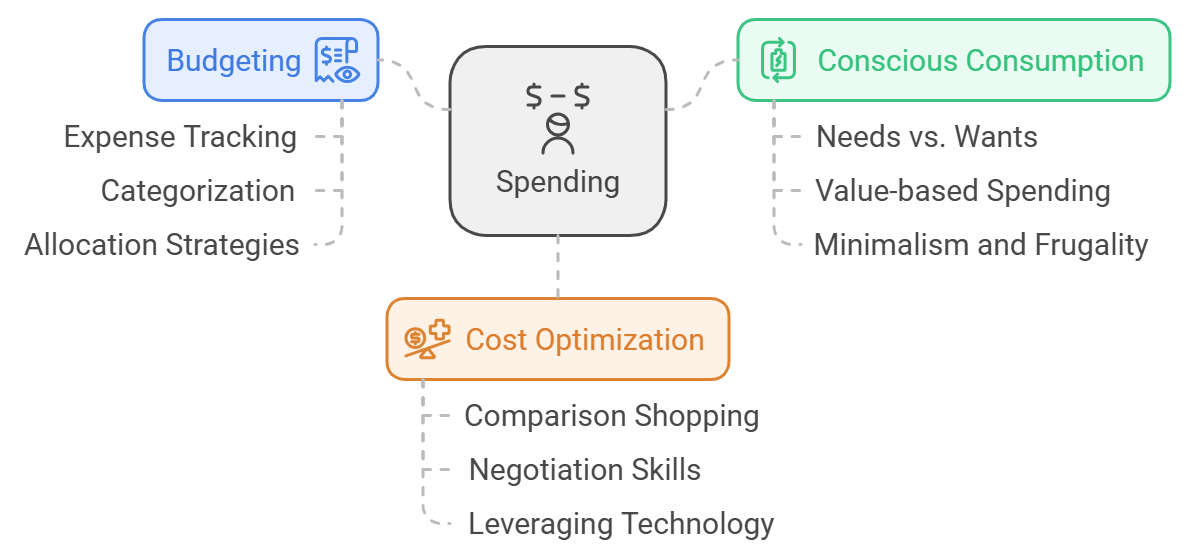

This model for spending can be thought of as a structured approach to managing money wisely, and it's broken down into three main areas: Budgeting, Conscious Consumption, and Cost Optimization.

Budgeting

Budgeting is the foundation of good financial management. It involves creating a plan for how you will spend your money, ensuring you cover your necessities, save, and avoid debt.

Expense Tracking:

What it means: This is the act of recording every financial transaction, including small purchases like coffee or bigger bills like rent.

Why it's important: It helps you understand where your money is going and prevents you from being surprised by how quickly you run out of funds.

How to do it: You can track expenses manually using a notebook, create an Excel sheet, or use apps like Mint or YNAB (You Need A Budget). Tracking even small expenses can highlight spending habits that you weren't aware of.

Example: If you find that you’re spending $100 a month on takeout, you might decide to cook at home more to save.

Categorization:

What it means: Organizing your expenses into different groups, like groceries, utilities, entertainment, savings, transportation, etc.

Why it’s important: Categorization helps you see the big picture of your spending, making it easier to adjust areas that might be going over budget.

How to do it: Most budgeting apps do this automatically, but you can also categorize manually. Categories should match your lifestyle (e.g., if you dine out often, create a "dining out" category).

Example: You might realize that your "entertainment" category is much higher than expected, prompting you to reduce it.

Allocation Strategies:

What it means: Deciding how much money to assign to each category, based on your income and financial goals.

Why it’s important: It keeps your spending in check and ensures that you have enough of the essentials while leaving room for savings and enjoyment.

How to do it: A common strategy is the 50/30/20 rule. This rule suggests allocating 50% of your income to needs (rent, utilities, food), 30% to wants (dining out, entertainment), and 20% to savings and debt repayment.

Example: If you earn $3,000 a month, $1,500 goes to needs, $900 to wants, and $600 to savings or paying off debt.

Conscious Consumption

This section is all about being intentional and thoughtful about how you spend your money, making sure you're getting value out of your purchases.

Needs vs. Wants:

What it means: This involves distinguishing between items or services that are essential for survival or well-being (needs) and those that enhance comfort or pleasure but aren't necessary (wants).

Why it’s important: Focusing on needs first ensures that your essentials (like housing, food, healthcare) are always covered, helping you avoid debt.

How to do it: Whenever you’re about to make a purchase, ask yourself, "Do I need this, or do I just want it?" Prioritize needs before splurging on wants.

Example: If your phone is still working but you’re tempted by the latest model, this is a want, not a need. You can delay upgrading and save money.

Value-based Spending:

What it means: This is the practice of spending money on things that align with your values and goals, rather than impulsively buying things.

Why it’s important: It ensures that your money goes toward things that truly matter to you and have a lasting impact, rather than momentary pleasures.

How to do it: Identify what you value most (e.g., travel, education, health) and prioritize spending in those areas. Avoid impulse buys that don’t align with your long-term goals.

Example: If you value travel, you might spend less on dining out or clothes so you can save up for a trip instead.

Minimalism and Frugality:

What it means: Minimalism focuses on living with fewer things and cutting out excess, while frugality emphasizes getting the most value for your money by spending carefully.

Why it’s important: It helps avoid clutter and financial waste. Minimalism can also lead to a simpler, more fulfilling life by focusing on experiences rather than material goods.

How to do it: Buy only what you need, look for second-hand items, and find joy in simplicity. Frugality means buying quality over quantity, looking for deals, and using what you already have.

Example: Instead of buying a new wardrobe every season, you could stick with timeless, durable clothes that last for years. Or, instead of subscribing to multiple streaming services, you might choose just one and make the most of it.

Cost Optimization

This section is about finding ways to get the most out of your money, whether through better deals, negotiation, or using technology to your advantage.

Comparison Shopping:

What it means: Before making a purchase, you compare prices across multiple stores or websites to find the best deal.

Why it’s important: It ensures that you aren’t overpaying for an item, maximizing your savings.

How to do it: Use price comparison websites or apps (like Google Shopping, Honey, or PriceGrabber), and be patient to check for discounts or sales.

Example: If you're buying a new laptop, you might find it at a better price during a sale or at a different retailer that offers a discount.

Negotiation Skills:

What it means: This involves asking for a better price or deal, whether you're buying something, renewing a service, or hiring someone for a job.

Why it’s important: Many businesses are open to negotiation, and asking for a better deal can save you money without reducing the quality of what you receive.

How to do it: Research before negotiating to know what others are paying, ask politely but confidently, and be willing to walk away if the deal isn’t good enough.

Example: When renewing your cable or internet plan, you can call the provider and ask for a discount or promotion, often leading to lower monthly payments.

Saving Strategies

Short-term Savings

Emergency fund: Money set aside for unexpected events like medical emergencies, car repairs, or job loss. It’s your financial safety net.

Sinking funds: A separate pot of money for planned expenses, like a vacation or a big purchase. You save little by little, so you're ready when the time comes.

High-yield savings accounts: These are savings accounts that offer a higher interest rate than regular ones, so your money grows faster, even if just sitting there.

Long-term Savings (USA)

Retirement accounts (401(k), IRA): Special accounts where you save money for your retirement. A 401(k) is typically through your employer, and an IRA is one you set up on your own. These accounts help your money grow for when you stop working.

Education savings (529 plans): This is a tax-advantage account for saving money for future education expenses, like college tuition.

Health Savings Accounts (HSAs): A savings account that helps you put money aside for medical expenses, with tax advantages.

Long-term Savings (India)

Employee Provident Fund (EPF): Similar to a 401(k) in the U.S., this is a government-backed retirement savings scheme where both the employee and employer contribute a portion of the employee’s salary. The fund earns interest, and the savings can be withdrawn at retirement or after certain conditions are met.

Public Provident Fund (PPF): A PPF is a long-term savings scheme with a fixed interest rate set by the government. It has a 15-year lock-in period, but you can make partial withdrawals after 7 years. It’s popular for its tax benefits, as the amount you invest, the interest earned, and withdrawals are all tax-free.

National Pension System (NPS): NPS is a government-run retirement savings scheme. You can invest in a mix of government securities, corporate bonds, and equities. It’s flexible and tax-efficient, and at retirement, you can withdraw a portion of the corpus and use the rest to buy an annuity for regular income.

Unit Linked Insurance Plans (ULIPs): ULIPs offer both insurance and investment options. A part of your premium goes towards life insurance, while the other part is invested in funds like equities or debt. While returns vary, it’s a long-term investment option that also provides tax benefits.

Sukanya Samriddhi Yojana (SSY): This is a savings scheme specifically for the education and marriage expenses of a girl child. It offers a high interest rate and tax benefits. Parents can invest for up to 15 years, and the account matures when the girl turns 21.

Equity Linked Savings Scheme (ELSS): ELSS funds are mutual funds that invest primarily in equities (stocks). They have a lock-in period of 3 years and offer tax benefits under Section 80C of the Income Tax Act. These are higher risk but can potentially offer higher returns compared to fixed-income options.

Saving Techniques

Automation: Setting up your savings to happen automatically, so a portion of your income goes directly into your savings accounts without you having to think about it.

Pay yourself first: This means saving a portion of your income before spending it on anything else. It ensures you always prioritize saving.

Savings challenges: Fun or motivating ways to save money, like trying to save a certain amount each day, or cutting out a certain type of expense (like coffee) for a month, and putting that money into savings instead.

Investment Model

Investing is the process of putting your money to work so it can grow over time. It's like planting a seed and watching it grow into a tree.

Where to Invest Your Money

Stocks: Think of these as tiny pieces of a company. When the company does well, the value of your stock can go up.

Bonds: These are like loans you give to a government or a company. They promise to pay you back with interest.

Mutual Funds and ETFs: These are like baskets of stocks or bonds. They're managed by professionals who pick the best investments.

Real Estate: Buying property like a house or land. The value of your property can increase over time.

Alternative Investments: These include things like collectibles, commodities, and hedge funds. They can be risky but can also offer high returns.

Key Investment Principles

Risk: How much you're willing to lose. Some investments are riskier than others.

Diversification: Spreading your money across different investments. This helps to reduce risk.

Asset Allocation: Deciding how much of your money goes into each type of investment. For example, you might decide to invest 60% in stocks, 30% in bonds, and 10% in real estate.

Rebalancing: Adjusting your investments to keep them in line with your asset allocation. This is important because the value of different investments can fluctuate over time.

Different Investment Strategies

Dollar-Cost Averaging: Buying the same amount of an investment at regular intervals. This helps to smooth out the impact of market fluctuations.

Value Investing: Buying investments that are undervalued. This means that the price of the investment is lower than its intrinsic value.

Passive vs. Active Investing: Passive investing involves buying and holding investments without actively trying to beat the market. Active investing involves trying to outperform the market by picking individual stocks or bonds.

Tax-Efficient Investing: Trying to minimize the taxes you pay on your investments. This can involve using tax-advantaged accounts like IRAs or 401(k)s.

Debt Management

Debt management is all about handling the money you owe in a smart and organized way. Here's a breakdown:

Types of Debt

Good Debt vs. Bad Debt:

Good Debt is when you borrow money to invest in something that will grow in value, like student loans (education) or a mortgage (home).

Bad Debt is borrowing for things that don’t increase in value, like credit card debt from shopping or expensive gadgets.

Secured vs. Unsecured Debt:

Secured Debt means you borrow money with something valuable (like a house or car) as collateral. If you don’t pay, the lender can take that item.

Unsecured Debt doesn’t have any collateral. Credit cards are a common example. If you don’t pay, they can’t take anything directly, but it will hurt your credit score.

Fixed vs. Variable Interest Rates:

Fixed Interest Rate means the interest you pay on your debt stays the same over time.

Variable Interest Rate can go up or down based on the market. It can be risky because your payments might increase if rates go up.

Debt Repayment Strategies

Debt Snowball:

Focus on paying off the smallest debt first while making minimum payments on the others. Once the smallest is gone, move to the next smallest, and so on. It's great for motivation because you see progress quickly.

Debt Avalanche:

Focus on paying off the debt with the highest interest rate first, while making minimum payments on the others. This method saves money in the long run because you pay less interest overall.

Debt Consolidation:

This means combining all your debts into one, usually with a lower interest rate. Instead of multiple payments, you make just one. It’s easier to manage, but sometimes it stretches out payments over a longer time.

Credit Management

Credit Scores and Reports:

A credit score is a number that shows how trustworthy you are when it comes to borrowing money. A high score means you're good at managing debt. A credit report is the detailed history of how you've handled debt—whether you’ve paid on time, missed payments, etc.

Credit Utilization:

This is the percentage of your available credit that you’re using. For example, if you have a credit limit of $1,000 and you’re using $300, your credit utilization is 30%. Keeping it under 30% is considered good for your credit score.

Negotiating with Creditors:

If you’re having trouble paying off debt, you can try negotiating with your lenders. They might lower your interest rate, reduce the amount you owe, or let you pay in smaller installments. It helps to show you're serious about paying, even if you need more time.

Financial Planning

Financial planning is like creating a roadmap for your money, ensuring that you are prepared for the present and future. Here’s a breakdown of its key parts:

Goal Setting

This is where you decide what you want your money to do for you. It’s about making clear, achievable goals:

SMART goals: These goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, "I want to save $5,000 for an emergency fund in 1 year" is a SMART goal.

Short-term vs. long-term goals: Short-term goals are things you want to achieve within a year, like saving for a vacation or paying off a small debt. Long-term goals are usually bigger, like buying a house or retiring, and may take several years or decades to achieve.

Life stage planning: Your financial goals change with your life stage. For example, in your 20s and 30s, you might focus on saving and investing, while in your 50s or 60s, retirement planning might become your priority.

Risk Management

This part is about protecting your financial health from unexpected events and managing taxes wisely:

Insurance planning: Getting the right kind of insurance—like health, life, and home insurance—can protect you from big, unexpected expenses.

Estate planning: This involves planning how your assets (money, property) will be handled after your death. Creating a will is an important part of this.

Tax planning: Making sure you don’t pay more taxes than necessary by taking advantage of tax-saving options like retirement accounts, tax deductions, and credits.

Financial Review and Adjustment

This step is about staying on top of your finances and adapting as needed:

Regular financial check-ups: Just like a doctor’s visit, it’s important to review your finances regularly. This means checking your savings, spending, and investment progress.

Adapting to life changes: Your financial plan should evolve as your life changes. This might include getting married, having kids, switching careers, or preparing for retirement.

Continuous learning and improvement: Stay updated on new financial tools, strategies, and laws. This helps you make smarter decisions and improve your financial health over time.

I really loved writing about this personal finance mental model. This mental model will now help me in understanding my finances and plan them in a better way. Honestly, before researching and writing about it, I was doing some and not doing some. Now, I will take care of that. If you also liked it, please share it with your friends or family who may need it.

SOMEONE CAN BENEFIT FROM IT

If you find this post helpful, we would be grateful if you could take a moment to share it with others who might benefit from it. Your kindness and support mean a lot to us.

DYNAMIC CONTENT

No one knows how deep a rabbit hole can go.

All our posts are regularly updated as soon as new information becomes available. We also keep note of the questions asked by our readers and add their answers to the article. So, stay curious and ask questions in the comments.

ABOUT THE AUTHOR

Hey everyone, I'm Garvit Sahdev 😎. I'm on a mission to gain a deeper understanding of the world, and to develop solutions that can trigger significant global change.

My curiosities span various domains including food, business theories, material science, market size calculations, economics, politics, and sports, etc. 🧐

Professionally, I have a diverse background spanning startups, consulting, policy development, market research, system building, ISO, colour physics, nanomaterial synthesis, textile chemistry, etc. 🐘

Note: Generative AI has been used for writing this piece under the supervision of the author.

Thanks for reading The Thoughtful Tangle! Subscribe to continue reading deeply researched stories about the interesting concepts that shape our world. ❤️