Hello, 👋

Currency is an asset with some associated value. Basically, its value is defined by how much you can buy in exchange for a unit of the currency in a geographical area. The geographical area here is important as each country has their own currency and the currency you are holding will have different buying capacities in different countries based on the exchange rates of the two currencies.

International trade and business thus require currency exchange, which happens in currency markets. Also, as a currency (asset) holder, you want to hold the currency which is growing at the fastest rate. In this post, we will understand the basics of currency markets and strategies to keep hold of the highest growing currencies. Enjoy!

Garvit Sahdev enjoys understanding ideas that shape our world. The Thoughtful Tangle is an initiative to share this journey and experience with his friends who love to do the same. He selects one idea and dives deep into it to understand its basics, relevance, impact and opportunities around it. The thoughtful tangle is special because 👇

📝 One long article per idea. We call it ‘The Basics’.

📝 Multiple unique insights. Separate small articles for special ‘Insights’.

🧑🤝🧑 Experts perspective. Check out ‘Insiders’

Once upon a time in a bustling city, there were two friends, Maya and Alex, who loved to explore new opportunities. Both were fascinated by the idea of making money in new ways, so when they heard about the world of currency trading, they decided to dive in.

But first, they needed to learn the basics. So, they sat down and began their journey into the exciting world of currency markets.

The Basics of Currency Markets

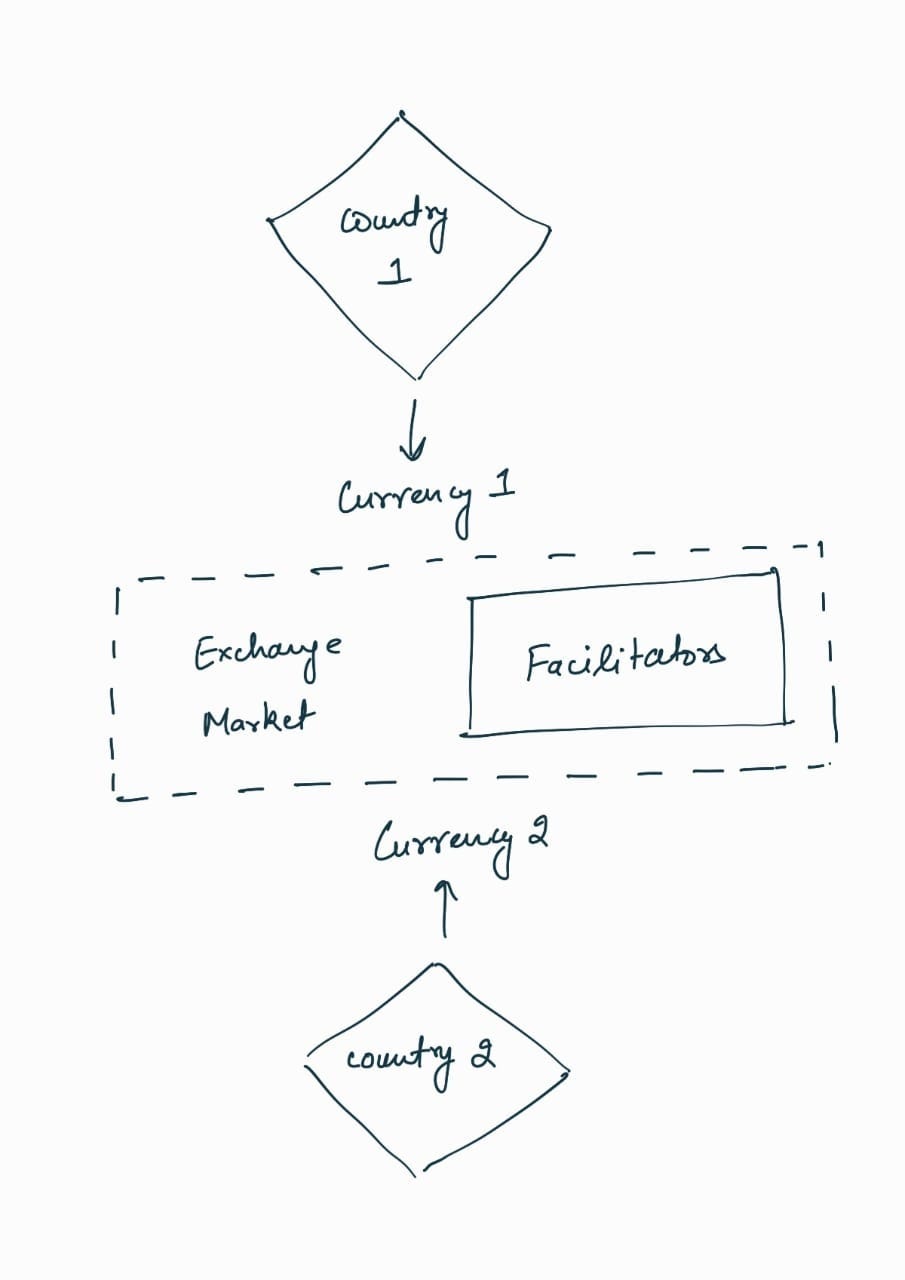

Maya and Alex learned that currency markets are places where different countries' currencies are bought and sold. These markets help people from different countries trade with one another. For example, if a business in Europe wants to buy products from the U.S., they need to exchange euros for U.S. dollars.

The two friends discovered that big players like central banks, commercial banks, hedge funds, and even small individual traders were part of this market.

What Are Exchange Rates?

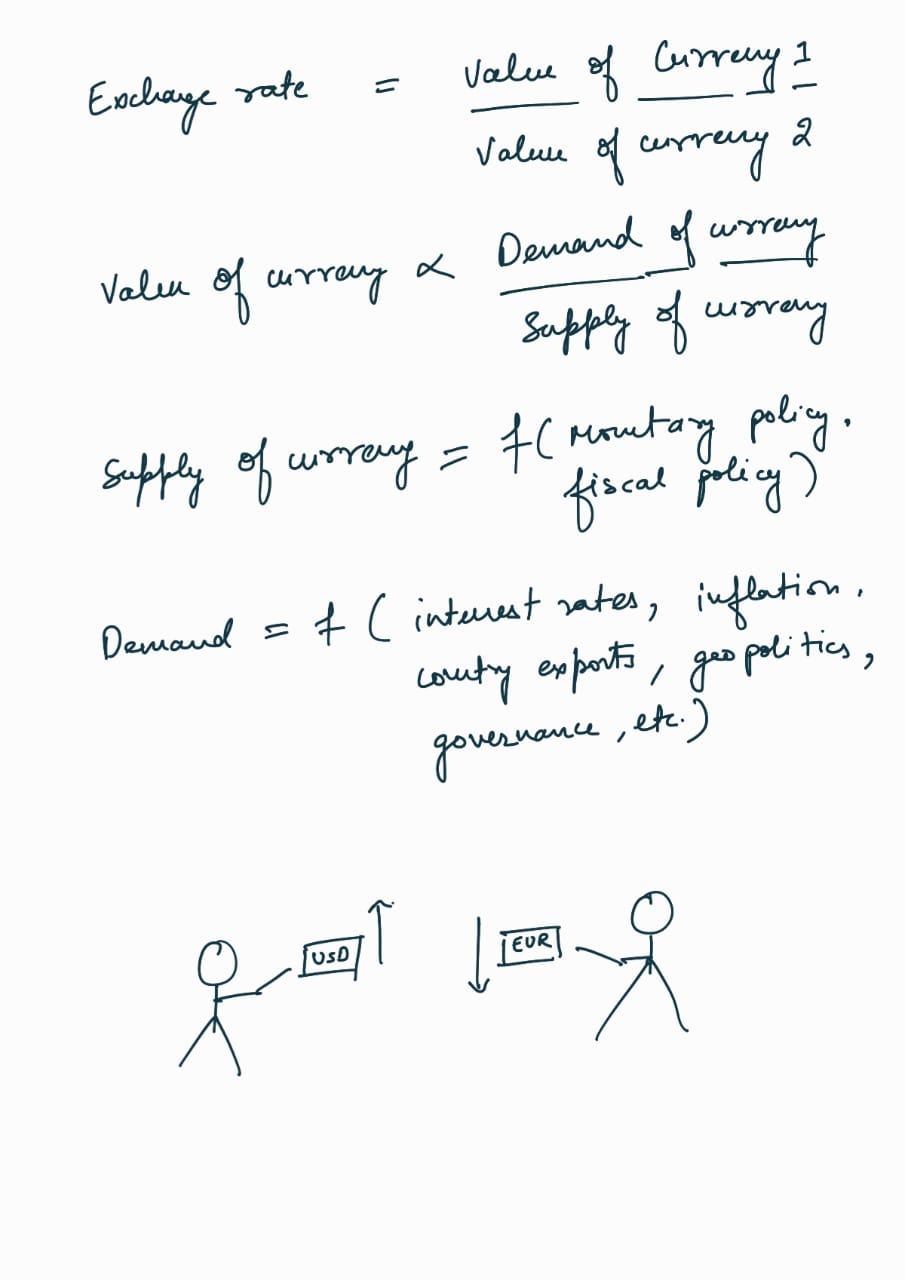

Maya was curious about how prices worked in this market. Alex explained that the price of one currency compared to another is called the exchange rate. For example, how many U.S. dollars would one euro get you? Some exchange rates change based on the market (called "floating"), while others are controlled by governments (called "fixed").

What Changes Exchange Rates?

Maya and Alex started looking deeper. What made exchange rates go up or down?

Alex found out that the economy played a big role. If a country’s interest rates go up, its currency often becomes stronger because people want to invest there. On the other hand, high inflation can weaken a currency because it reduces the currency's buying power.

Politics was another big factor. Elections, government changes, or even global events could send exchange rates moving.

And, of course, market sentiment—the mood of the people trading in the markets—could impact things. Sometimes people just felt that a currency would rise or fall, and their actions made it happen.

Understanding Currency Pairs

As they dug deeper, they learned that in the currency markets, you never trade just one currency. You trade in pairs. For example, you could trade U.S. dollars for Japanese yen (USD/JPY). Some pairs are more common and called "major pairs," like EUR/USD (euro and U.S. dollar). Others, like exotic pairs, involve currencies from smaller or emerging markets.

How Do You Trade?

One day, Maya asked, "How do we actually trade these currencies?"

Alex smiled and explained that there are a few different ways. They could trade immediately at the current price (called the spot market), or they could agree to trade at a specific price in the future (called the forward market). There were even futures markets with standardized contracts for future trades and options markets where you could decide whether or not to buy or sell at a certain price later.

Who's Involved?

The two friends soon realized they weren’t the only ones exploring currency markets. Banks were some of the biggest players. Large corporations also traded currencies when they did business internationally. Investment firms traded to make money, and central banks used currency trading to help manage their economies.

Even retail traders, like Maya and Alex, were getting involved. This mix of players made the market dynamic and fast-moving.

Learning to Analyze the Market

Maya loved analyzing things, so she dived into two types of analysis: technical and fundamental.

Technical analysis focused on chart patterns, trend lines, and tools like moving averages. She found it fun to spot patterns that could predict where the market might go.

On the other hand, Alex preferred fundamental analysis. He looked at economic reports, central bank decisions, and big political events that could affect currencies.

Together, they made a great team—combining technical and fundamental analysis to try to make the best decisions.

Market Dynamics

Maya noticed that the currency market was always active. It moved with the sun—starting in Asia, then Europe, and finally the Americas. Liquidity was high for major pairs like EUR/USD, meaning they could buy and sell easily. But exotic pairs weren’t as liquid, and they sometimes saw bigger price swings.

Volatility also changed depending on the news. Economic events, central bank announcements, and political changes could make the market bounce up and down.

The Bigger Picture

Maya and Alex realized that currencies didn’t move in isolation. They saw that currencies were often linked to other markets. For example, when commodity prices like gold went up, the Australian dollar (AUD) often strengthened. The performance of stock markets also affected currency values as traders shifted their risk preferences.

Global Financial System

Alex was fascinated by the global financial system. He learned that some currencies, like the U.S. dollar, were reserve currencies. This meant countries held them in large amounts to help stabilize their economies. International organizations like the IMF and World Bank also influenced how currencies moved by supporting countries in times of need.

Trading Strategies

Once Maya and Alex had a firm understanding of the basics of currency markets, they decided it was time to develop some real strategies to trade. Their excitement was tempered by the realization that making consistent profits wasn’t going to be as simple as buying and selling currencies. They needed a plan—several plans, in fact.

One afternoon, Maya and Alex sat in their favorite café, sipping coffee and poring over their laptops. They had learned that there were many different strategies traders used to profit from currency markets. They decided to try them out one by one to see which ones worked best for them.

Trend Following: "The Trend is Your Friend"

Maya had always been fascinated by patterns, so she was naturally drawn to trend following. The idea was simple: find a currency pair that was trending in one direction, and ride that trend until it reversed. For this, she used tools like moving averages and trendlines to help identify when a trend was strong.

One day, she noticed that the EUR/USD pair had been steadily climbing. Using her indicators, she decided to buy and hold the euro, expecting the upward momentum to continue. She felt confident, knowing that she was trading with the flow of the market.

But while trend following could yield big rewards, Maya quickly learned the downside. One morning, the trend she had been following reversed sharply due to unexpected political news, and she was caught off guard. "Trend following is powerful," she thought, "but it’s important to be ready for those sudden reversals."

Range Trading: Oscillating Between Highs and Lows

Alex, on the other hand, found himself drawn to range trading. He noticed that sometimes markets didn’t trend in one direction but moved back and forth between a high and a low point. The strategy was simple: buy when the currency was near the lower support level, and sell when it reached the upper resistance.

One day, Alex saw that the GBP/USD pair was bouncing between two clear levels for weeks. He started buying near the support and selling at the resistance, making small, consistent profits. It was like timing the swings of a pendulum.

But Alex also faced challenges. After weeks of range-bound trading, the pound suddenly broke through the resistance level and began trending upward. His range strategy no longer worked, and he realized that market conditions could change unexpectedly. He made a mental note to be prepared to switch strategies when needed.

The Carry Trade: Earning Through Interest Rates

Maya soon became intrigued by the concept of the carry trade. The idea here was to borrow a currency with low interest rates and use it to buy a currency with higher interest rates, profiting from the difference. It was a popular strategy in calm markets.

Maya borrowed Japanese yen, which had very low interest rates, and bought Australian dollars, which had higher rates. She liked the steady returns the carry trade offered, but she quickly realized the risks. One day, global markets became unstable, and investors rushed to safer currencies. The Australian dollar dropped sharply, wiping out her profits.

"Carry trades are great when markets are stable," Maya thought, "but they can unwind quickly in times of crisis."

News Trading: Fast and Furious

Alex was always plugged into the news, so it made sense for him to try news trading. This strategy involved making trades based on economic data releases or political events. If a country released better-than-expected employment data, its currency might strengthen, and Alex could jump in to ride the wave.

One day, he watched as the U.S. Federal Reserve made a surprise announcement about raising interest rates. Alex quickly bought U.S. dollars, and sure enough, the currency shot up in value. He was thrilled by the adrenaline rush of trading the news.

However, news trading required lightning-fast decisions, and Alex discovered the downside of volatility. Not every news event moved the market in predictable ways, and sometimes the reaction was short-lived. "This is a high-risk, high-reward strategy," Alex thought, "and it’s definitely not for the faint-hearted."

Breakout Trading: Capturing Big Moves

Maya found herself experimenting with breakout trading. This strategy involved waiting for a currency to break out of its established range—either above resistance or below support—and then jumping in to catch the big move that often followed.

One afternoon, Maya saw that the USD/JPY pair had been stuck in a narrow range for weeks. When the price finally broke through resistance, she quickly bought dollars and saw the price soar. It was exciting to catch the beginning of a major move.

But false breakouts were common, and Maya had to stay alert to avoid them. One time, she entered a trade too early, only for the price to reverse and return to its previous range. "Breakouts are thrilling," she reflected, "but you have to be careful to confirm the move before jumping in."

Swing Trading: Balancing the Short and Long Term

Alex liked the idea of swing trading because it allowed him to capture medium-term price movements. He would hold a position for several days or even weeks, trying to catch the larger "swings" in the market.

One day, Alex noticed the EUR/GBP pair was in a downtrend, so he sold euros and bought British pounds. Over the next week, the euro continued to weaken, and Alex was able to ride the swing down before exiting at a key support level.

Swing trading required patience, and Alex knew he needed to manage his trades carefully to maximize his profits. "It’s a balance," he said to Maya. "You need to be patient but also know when to exit before the market turns."

Scalping: Quick and Focused

On days when they had more time to sit in front of their screens, Maya and Alex tried scalping. This strategy involved making a lot of small trade, aiming for tiny profits each time. They would focus on small price movements that happened within minutes.

Maya liked the fast pace of scalping, while Alex enjoyed the thrill of making many trades in a short period. However, they soon realized that scalping required intense focus, and the small profits could easily be eaten up by transaction costs if they weren’t careful.

"It’s a great way to accumulate small gains," Maya admitted, "but it’s definitely not a strategy we can use all the time."

Position Trading: Thinking Long-Term

As their skills grew, Alex became more comfortable with position trading. This strategy focused on capturing long-term trends, often holding positions for weeks, months, or even years. It required a deep understanding of macroeconomic factors and long-term market trends.

One time, Alex bought U.S. dollars when he saw signs that the American economy was strengthening. He held onto his position for several months, watching as the dollar steadily gained value. Position trading allowed him to step back from the daily market noise and focus on the bigger picture.

But position trading required patience and a larger capital base. Alex knew it wasn’t for everyone, especially since it tied up funds for long periods. "It’s great if you can wait for the big moves," he told Maya, "but you have to be willing to play the long game."

Algorithmic Trading: The Power of Technology

Always interested in technology, Maya started exploring algorithmic trading. She loved the idea of creating computer programs that would automatically trade based on specific rules. This strategy removed the emotional aspect of trading and relied purely on data.

Maya spent hours learning how to program her algorithms, testing them with historical data to see how they would perform. It was thrilling to see her algorithms execute trades faster than she ever could.

However, she also realized that algorithmic trading required a lot of technical expertise and could malfunction if market conditions changed unexpectedly. "It’s a powerful tool," Maya said, "but it’s not a magic bullet."

Toolkit for Mastering Currency Markets

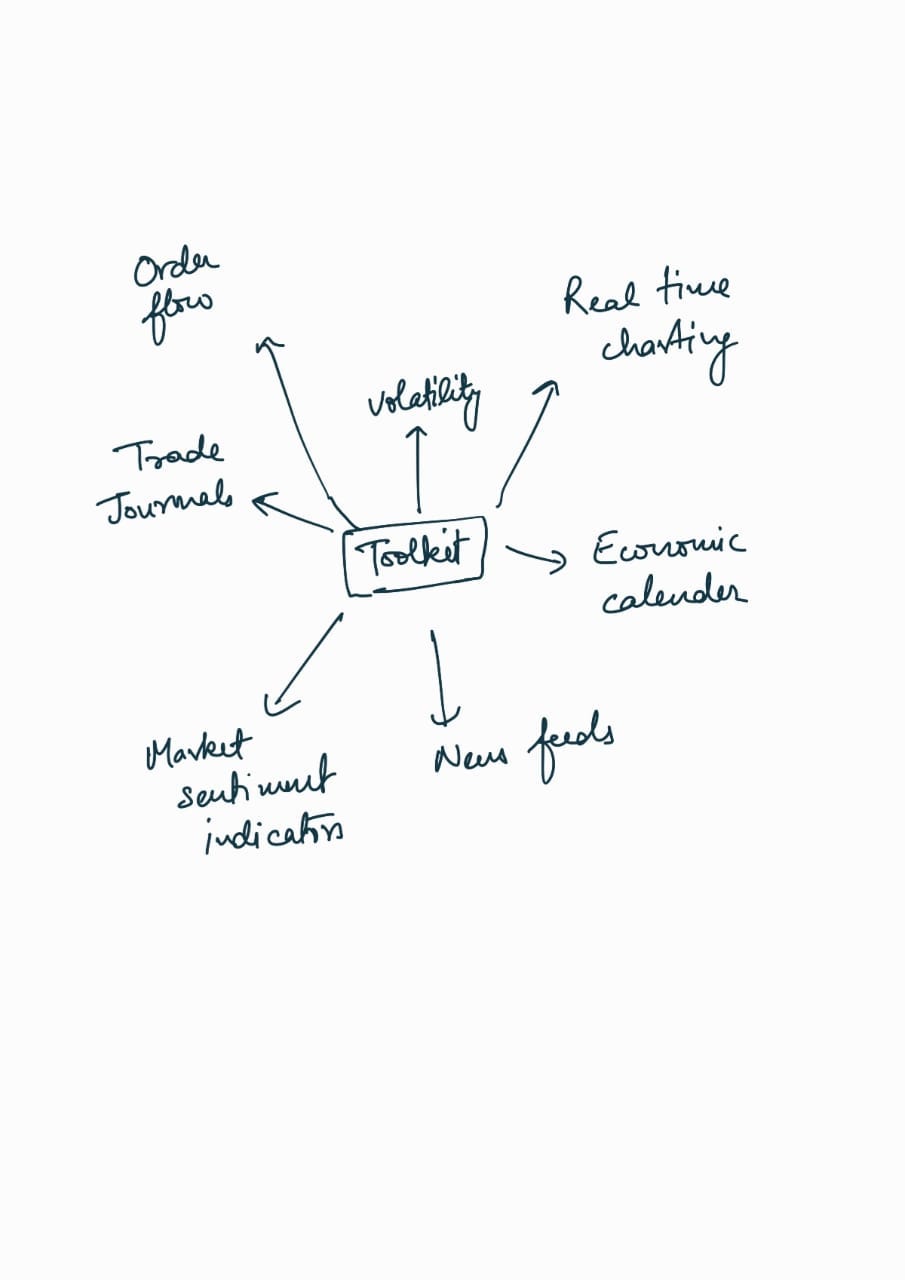

After months of experimenting with different trading strategies, Maya and Alex knew that if they wanted to succeed as traders, they would need more than just good instincts. They needed a solid toolkit to monitor the markets, track their trades, and make better decisions. One evening, sitting at their trading desks, they decided to dive deeper into the vast array of tools available to traders.

The Power of Real-Time Charting

Maya started with real-time charting software, like TradingView and MetaTrader, that had become her best friend. These platforms provided her with advanced charting capabilities, allowing her to monitor different timeframes and customize technical indicators to fit her strategies. Whether she was trend-following or trying to catch a breakout, having the right charts in front of her made a world of difference.

"With these charts, I can get a better feel for market movements," Maya explained. "I can switch between different timeframes and add indicators that help me spot opportunities."

Staying Updated with the Economic Calendar

Alex, always in tune with the news, made the economic calendar his priority. This calendar showed the upcoming economic events and data releases that could shake up the markets. Central bank decisions, employment reports, and inflation data became key moments for him.

"I never want to be caught off guard," Alex said as he scrolled through the economic calendar. "Knowing when major events are happening helps me prepare my trades in advance."

The Flow of News and Market Sentiment

To stay on top of global events, both Maya and Alex subscribed to real-time news feeds from Bloomberg and Reuters. They also monitored social media platforms like Twitter, where market sentiment could shift quickly based on a single tweet from a prominent figure.

On top of that, Maya began using market sentiment indicators like the Commitment of Traders (COT) reports and the Fear & Greed index. These tools helped her gauge the mood of the market and decide whether it was time to buy or sell.

"It's not just about the numbers," Maya remarked. "Understanding the sentiment behind those numbers gives me an edge."

Mastering Technical and Fundamental Analysis

As their trading evolved, Maya and Alex relied heavily on technical analysis tools. Maya favored trend indicators like Moving Averages and MACD, while Alex kept a close eye on momentum indicators like RSI and Stochastic. These tools helped them confirm their strategies, whether they were trading breakouts or ranges.

But they didn’t stop there. They also focused on fundamental analysis resources, such as central bank statements, GDP reports, and inflation data. Maya learned how to interpret these data points to form a clearer picture of long-term currency trends.

"Technical analysis shows you what's happening now," Maya said. "But fundamental analysis tells you why it's happening."

Risk Management Tools and Trade Journals

As their trading became more sophisticated, Maya and Alex knew that managing their risk was critical. They started using position size calculators and risk-reward ratio calculators to make sure they weren’t overexposed in any one trade. This gave them the confidence to scale up their positions while keeping their risk in check.

Alex also began keeping a detailed trade journal using specialized software. He logged every trade, noting why he entered, how it played out, and what he could have done better. Over time, this journal became a goldmine of insights that helped him identify patterns in his trading behavior.

"This journal is like a mirror," Alex said one day. "It shows me my strengths and weaknesses, and it’s helping me become a better trader."

Order Flow and Market Depth

While Maya and Alex felt they were getting a good handle on their trading, they realized that the real action was happening beneath the surface. They started exploring market depth and order flow tools. With Level 2 market data and order flow analysis software, they could see where the big players were placing their orders and how the market might react.

"This is where the institutions play," Alex observed. "Understanding the order flow gives us a glimpse into their strategies."

Tracking Volatility and Correlations

To avoid nasty surprises, Maya began monitoring volatility indicators like Bollinger Bands and ATR, which helped her measure how much a currency was likely to move. This allowed her to adjust her position sizes and stop-loss orders based on how volatile the market was.

Meanwhile, Alex started using correlation trackers to understand the relationships between currency pairs. He discovered that certain currencies often moved in tandem with commodities or other financial assets.

"It’s all connected," Alex said. "If you know how currencies correlate with each other, you can reduce your risk and find hidden opportunities."

________

Over time, Maya and Alex became more confident in the currency markets. They understood that it wasn’t just about quick profits but about understanding a global system of interconnected markets. They learned to think critically, manage their risks, and stay patient as they honed their skills.

And so, Maya and Alex's adventure in the currency markets continued. They knew there was always more to learn, but with their new understanding of how currency markets worked, they were well on their way to becoming successful traders.

____________

I hope you liked the story. I am experimenting with the story format with money series. Let me know if you have any feedback. See you next time.

SOMEONE CAN BENEFIT FROM IT

If you find this post helpful, we would be grateful if you could take a moment to share it with others who might benefit from it. Your kindness and support mean a lot to us.

DYNAMIC CONTENT

No one knows how deep a rabbit hole can go.

All our posts are regularly updated as soon as new information becomes available. We also keep note of the questions asked by our readers and add their answers to the article. So, stay curious and ask questions in the comments.

ABOUT THE AUTHOR

Hey everyone, I'm Garvit Sahdev 😎. I'm on a mission to gain a deeper understanding of the world, and to develop solutions that can trigger significant global change.

My curiosities span various domains including food, business theories, material science, market size calculations, economics, politics, and sports, etc. 🧐

Professionally, I have a diverse background spanning startups, consulting, policy development, market research, system building, ISO, colour physics, nanomaterial synthesis, textile chemistry, etc. 🐘

Note: Generative AI has been used for writing this piece under the supervision of the author.

Thanks for reading The Thoughtful Tangle! Subscribe to continue reading deeply researched stories about the interesting concepts that shape our world. ❤️