Beware the Lure of Glittering Gold

Jewelry may not be the best decision to capitalise on rising gold prices

Hello, 👋

For years my family have been investing in jewelry and they were content with the rising gold prices that there investment is safe and will give them good returns. Jewelry definitely serves multiple cultural purposes apart from investment. But when you do the maths, you realize that there are other gold investment instruments which give better returns than jewelry in the short and long run.

In this post, we will learn about those instruments and see how they play in multiple investment durations. Again, I am doing this out of curiosity and not as an investment advisor. It's crucial to consult with a financial advisor to assess your individual financial situation and risk tolerance before making investment decisions. I hope you will enjoy this.

Garvit Sahdev enjoys understanding ideas that shape our world. The Thoughtful Tangle is an initiative to share this journey and experience with his friends who love to do the same. He selects one idea and dives deep into it to understand its basics, relevance, impact and opportunities around it.

We are doing a series on ‘money’ as it is truly an idea which shaped the evolution of humanity and is still shaping it in many ways. Check out this series at

» The Money Series | The Thoughtful Tangle

Physical Gold

Physical gold has been a trusted store of value for centuries, making it a reliable hedge against inflation and currency devaluation. It acts as a safe haven during economic and geopolitical uncertainty, providing stability in times of financial turmoil. Unlike paper assets, physical gold is tangible, universally recognized, and easily liquidated in markets worldwide. It also offers a sense of security as a form of wealth you can directly hold, free from the risks associated with financial instruments like bonds or stocks. This makes it an attractive choice for risk-averse investors seeking diversification in their portfolios.

Physical gold is traded in the form of two types i.e. Bullion (Bars, Coins) & Jewelry.

Bullion refers to pure gold available in standardized sizes, typically ranging from small gram weights to larger kilogram bars. Its purity is usually high, often 99.5% or 24-karat, making it ideal for investors focused on maximizing the intrinsic value of their gold holdings.

Gold Jewelry combines artistic craftsmanship with the intrinsic value of gold, making it a unique asset that serves both cultural and financial purposes. While it can also serve as an investment, its financial value is somewhat diminished by high making charges and potential depreciation due to wear-and-tear.

Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds (SGBs) are government-issued securities designed to provide a secure and efficient way to invest in gold without the hassle of physical storage. These bonds are directly linked to gold prices, ensuring that the value tracks the prevailing market rates.

Ideal for long-term investors, SGBs offer an annual interest of 2.5% on the initial investment amount, paid semi-annually, which adds a fixed income component to the gold investment. Another key advantage is the absence of storage costs, unlike physical gold, and the tax-free capital gains on redemption if held until maturity (8 years). Investors can purchase a minimum of 1 gram and up to 4 kilograms annually, making it accessible for both small and large-scale investments.

If Sovereign Gold Bonds (SGBs) are sold before the completion of the 8-year maturity period, following things happen:

Interest is paid semi-annually, but if sold before 8 years, you will only receive interest for the years you hold the bonds. For example, if the bonds are sold after 5 years, you would receive interest for those 5 years.

The 2.5% annual interest is taxable, and you'll need to pay tax on it as per your income tax slab.

Long-Term Capital Gains (LTCG): If the bonds are sold after 5 years but before 8 years, the gains will be taxed as long-term capital gains. The LTCG tax rate is 12.5% without indexation benefits.

Gold Exchange-Traded Funds (Gold ETFs)

Gold Exchange-Traded Funds (Gold ETFs) are mutual funds that aim to replicate the performance of gold by holding physical gold or gold-related assets. These funds are traded on stock exchanges, making them a convenient and highly liquid investment option for those who wish to invest in gold without the challenges of physical possession, such as storage and security concerns.

Gold ETFs provide a way for investors to gain exposure to gold prices without the need to buy, store, or insure physical gold. The price of Gold ETFs generally moves in tandem with the price of gold, reflecting its real-time market value. One of the key benefits of Gold ETFs is that they do not have making charges or storage costs, which are typically associated with purchasing physical gold (bullion or jewelry).

However, investors do need a Demat account to buy and sell Gold ETFs, and the transaction costs (brokerage fees) may vary depending on the platform used for trading (avg ~ 1%). Gold ETFs are ideal for investors looking for an easy, cost-effective way to gain exposure to the gold market while maintaining the flexibility of liquid, tradable assets.

Digital Gold

Digital Gold is a modern investment option allowing individuals to purchase and hold gold in fractional quantities through online platforms like Paytm, PhonePe, and other fintech apps. This form of gold investment is designed for small-scale and flexible investors who want exposure to gold without worrying about physical storage or handling.

When purchased, the equivalent quantity of gold is stored in insured custodian vaults on behalf of the buyer, eliminating storage risks. Investors can start with amounts as low as ₹1, making it an accessible option for everyone. Digital Gold is backed by 24-karat gold and can be sold or redeemed at market prices anytime, with options for physical delivery if desired.

However, resale or redemption may incur additional charges, such as platform fees or delivery costs. This convenience comes at a premium compared to other gold investments like Sovereign Gold Bonds or ETFs, as there are no tax benefits and marginally higher transactional costs.

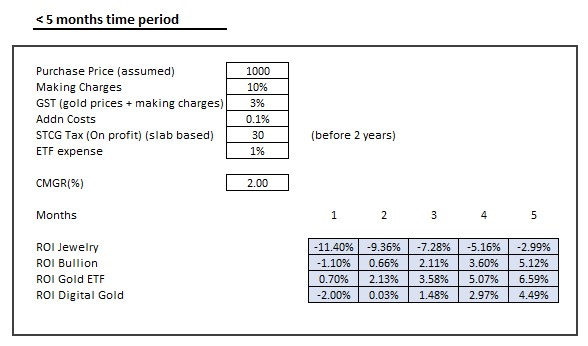

Gold Investment Options for Less Than 5 Months

This table compares the ROI (Return on Investment) for different gold investment options—Jewelry, Bullion, Gold ETF, and Digital Gold—over a period of less than five months. This is generally for the conditions when you know that gold prices will increase sharply in the short run due to some external stimuli.

Assumptions Used in the Analysis:

Purchase Price: ₹1,000 (used for uniform comparison).

Making Charges (10%): Applicable only to jewelry and significantly impacts short-term returns.

GST (3%): Added to the cost of jewelry, bullion and digital gold but not applicable to Gold ETFs.

Additional Costs (0.1%): Nominal fees associated with all investments.

Short-Term Capital Gains Tax (30%): Applied on profits made from jewelry, bullion, ETFs and Digital Gold for a holding period under two years.

ETF Expense Ratio (1%): Annual cost for managing Gold ETFs.

Gold Price Growth Rate (CMGR): Assumed to grow at 2% per month over the analysis period. This rate is on the conservative side.

Performance Comparison:

1. Jewelry:

ROI: Starts at -11.40% in the first month and improves marginally to -2.99% after five months.

Reason for Poor Performance:

High making charges (10%) combined with GST (3%) drastically reduces the initial value.

Short-term price appreciation of gold cannot compensate for these costs.

Implication: Jewelry is unsuitable for short-term investments and should only be purchased for long-term investment or cultural/emotional reasons.

2. Bullion:

ROI: Starts at -1.10% in the first month, turns positive by the second month (0.66%), and grows to 5.12% after five months.

Reason for Better Performance:

Lower upfront costs compared to jewelry (GST is present but no making charges).

Implication: Bullion performs well for short- to medium-term investments, offering better returns than jewelry with manageable costs. Allows you to directly own the asset which is not possible for ETFs and digital gold.

3. Gold ETF:

ROI: Starts at -0.70% in the first month, turns positive by the second month (2.13%), and grows to 6.59% by the fifth month.

Reason for Performance:

No GST or making charges, leading to higher initial value retention.

Even with the ETF expense ratio (1%) and STCG tax, ETFs offer better short-term ROI due to price appreciation and liquidity.

Implication: Gold ETFs are a strong choice for short-term investments due to their low costs and high liquidity.

4. Digital Gold:

ROI: Starts at -2.00% in the first month, turns positive in the third month (1.48%), and grows to 4.49% after five months.

Reason for Performance:

Marginally higher costs (platform fees, resale charges & GST) compared to ETFs.

Implication: Digital Gold is convenient for small-scale investors but offers slightly lower returns than ETFs for short-term periods.

For short-term investments (less than 5 months), Gold ETFs are the most favorable option, followed closely by Bullion. Digital Gold is convenient but slightly less profitable, while Jewelry should be avoided for investment purposes in the short term. This highlights the importance of cost structures and taxation when evaluating gold investment options.

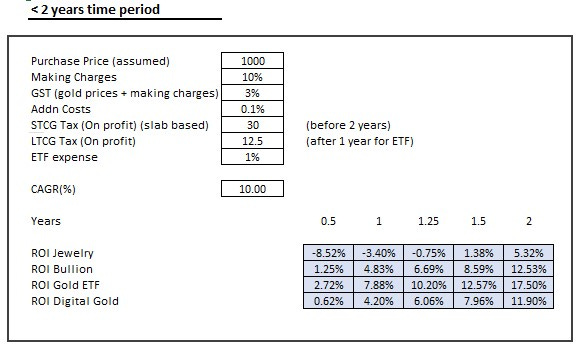

Gold Investment Options for 5 months to 2 years

This table evaluates the ROI (Return on Investment) for different gold investment instruments—Jewelry, Bullion, Gold ETF, and Digital Gold—over a time period of less than 2 years.

Assumptions Used in the Analysis:

Purchase Price: ₹1,000.

Making Charges (10%): A significant cost for Jewelry.

GST (3%): Applied to Jewelry, Bullion and Digital Gold.

Additional Costs (0.1%): Common across all instruments.

Taxation:

Short-Term Capital Gains Tax (30%): Applied to ETFs for profits under one year and for profits under two years for rest of the instruments.

Long-Term Capital Gains Tax (12.5%): Applied after one year for ETFs

ETF Expense Ratio (1%): Annual fee deducted for Gold ETFs.

Performance Comparison:

1. Jewelry:

ROI Performance:

Starts negative at -8.52% (6 months) due to high making charges and GST.

Gradually improves to 5.32% by 2 years as the gold price appreciates.

Reason for Low ROI:

High upfront costs (10% making charges + 3% GST) erode initial value.

Implication:

Jewelry is a poor choice for investments under two years, as the high costs are only offset by substantial long-term price appreciation.

2. Bullion:

ROI Performance:

Starts at 1.25% after 6 months and grows steadily to 12.53% after 2 years.

Reason for Better Returns:

No making charges, but GST (3%) slightly reduces the initial value.

Implication:

Bullion is a stable and straightforward investment option for medium-term investors.

3. Gold ETFs:

ROI Performance:

Starts at 2.72% (6 months), improves to 7.88% (1 year), and reaches 17.50% after 2 years.

Reason for High ROI:

No GST or making charges, with minimal expense ratios (1%).

Tax efficiency: LTCG tax (12.5%) after 1 year lowers the impact of taxation on returns.

Implication:

Gold ETFs are the most profitable and efficient instrument for investments up to 2 years, provided you have a Demat account.

4. Digital Gold:

ROI Performance:

Starts at 0.62% (6 months), grows to 7.96% (1.5 years), and reaches 11.90% after 2 years.

Reason for Moderate Returns:

Similar benefits as ETFs (no making charges), but platform fees, GST and resale charges slightly reduce the returns.

Implication:

Digital Gold is a good option for investors seeking convenience and fractional investments, though it underperforms compared to ETFs over the same period.

ROI Comparison for < 2 Years:

Gold ETFs (17.50%): Offer the highest returns for medium-term investments.

Bullion (12.53%): Reliable and steady returns without complex requirements.

Digital Gold (11.90%): Moderate returns with added convenience.

Jewelry (5.32%): Significantly lower returns due to high upfront costs.

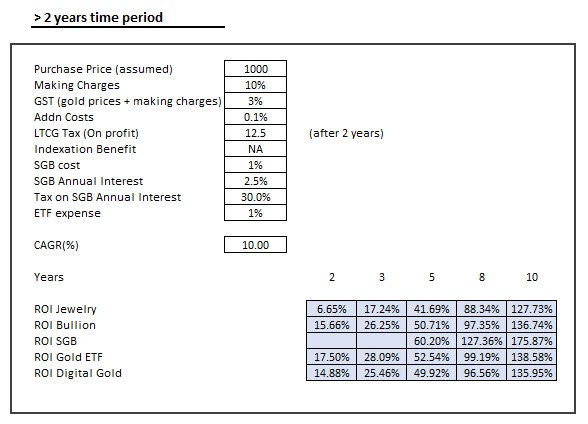

Gold Investment Options for > 2 years

The table presents a financial analysis comparing the returns on investment (ROI) of various gold investment options over different time periods (2, 3, 5, 8, and 10 years).

Interpretation:

SGBs consistently outperform other options due to the tax-efficient structure and annual interest.

Gold ETFs offer a relatively higher ROI compared to physical gold (jewelry and bullion) due to lower costs and potential tax benefits.

Digital Gold provides a convenient and cost-effective way to invest in gold, with returns comparable to physical bullion.

Jewelry and Bullion have lower returns due to the impact of making charges, GST, and LTCG.

Key Takeaways:

SGBs are generally the most tax-efficient and lucrative option for long-term gold investment.

Gold ETFs offer a balance of convenience and potential returns.

Digital Gold provides a cost-effective and accessible way to invest in gold.

Physical gold (jewelry and bullion) has higher costs and lower returns compared to other options.

Factors that affect gold prices in India

Now, you know the types of gold and why to invest in them. But all returns are based on a primary assumption that gold prices will increase at a certain rate. Now, let’s see what factors influence the price of gold.

International Gold Prices

Correlation: Positive.

Gold is a globally traded commodity. Changes in international gold prices directly impact domestic prices in India. If global gold prices rise, Indian gold prices also increase.

Indian Rupee vs. US Dollar Exchange Rate

Correlation: Negative.

Gold is traded internationally in USD. A weaker Indian Rupee increases the cost of importing gold, raising domestic prices. Conversely, a stronger Rupee can lower gold prices.

Inflation Rates

Correlation: Positive.

Gold is seen as a hedge against inflation. Higher inflation reduces the purchasing power of currency, leading to increased demand for gold and higher prices.

Interest Rates

Correlation: Negative.

Higher interest rates increase the opportunity cost of holding gold, leading to lower demand and prices. Conversely, lower interest rates boost gold prices.

Geopolitical and Economic Uncertainty

Correlation: Positive.

Gold is considered a safe-haven asset. Economic crises, wars, or political instability increase demand for gold, leading to higher prices.

Crude Oil Prices

Correlation: Positive.

Higher crude oil prices increase inflationary pressures and weaken the Rupee, indirectly boosting gold prices.

Stock Market Performance

Correlation: Negative.

When stock markets perform well, investors shift away from gold to equities, leading to lower demand and prices. Conversely, during market downturns, gold becomes a preferred investment, increasing prices.

Global Economic Indicators (GDP, Unemployment)

Correlation: Indirectly Positive.

Poor economic performance, such as low GDP growth or high unemployment, often leads investors to favor gold, driving up prices.

Global Trade Tensions

Correlation: Positive.

Trade wars or disruptions increase uncertainty in global markets, leading to higher demand for gold as a safe haven.

US Treasury Yields

Correlation: Negative.

Higher yields on US Treasury bonds make them more attractive relative to gold, reducing demand and prices for gold.

Global Gold Reserves

Correlation: Positive.

When central banks globally add to their gold reserves, it signals confidence in gold's value, boosting prices.

Now, remember that the impact of these factors can add up but also can cancel each other. So, do proper analysis and talk to experts before taking any investment decisions.

Note:

This analysis is based on specific assumptions and may not reflect actual investment outcomes.

It's crucial to consult with a financial advisor to assess your individual financial situation and risk tolerance before making investment decisions.

SOMEONE CAN BENEFIT FROM IT

If you find this post helpful, we would be grateful if you could take a moment to share it with others who might benefit from it. Your kindness and support mean a lot to us.

DYNAMIC CONTENT

No one knows how deep a rabbit hole can go.

All our posts are regularly updated as soon as new information becomes available. We also keep note of the questions asked by our readers and add their answers to the article. So, stay curious and ask questions in the comments.

ABOUT THE AUTHOR

Hey everyone, I'm Garvit Sahdev 😎. I'm on a mission to gain a deeper understanding of the world, and to develop solutions that can trigger significant global change.

My curiosities span various domains including food, business theories, material science, market size calculations, economics, politics, and sports, etc. 🧐

Professionally, I have a diverse background spanning startups, consulting, policy development, market research, system building, ISO, colour physics, nanomaterial synthesis, textile chemistry, etc. 🐘

Note: Generative AI has been used for writing this piece under the supervision of the author.

Thanks for reading The Thoughtful Tangle! Subscribe to continue reading deeply researched stories about the interesting concepts that shape our world. ❤️